CHINA HAS ORDERED IT’S BANKS TO STOP PURCHASING U.S. DOLLARS

In a stunning move, China has suspended some banks from Foreign Exchange markets and ordered other banks to stop buying Dollars.

China’s foreign exchange regulator has ordered banks in some of the country’s major import and export centers to limit purchases of U.S. dollars this month, three people with direct knowledge said, in the latest attempt to stem capital outflows.

The move comes as China reported its biggest annual drop in foreign exchange reserves on record in 2015, while the central bank has allowed a sharp slide in the Yuan currency to multi-year lows, raising fears of more capital flight.

All banks in certain trading hubs, including Shenzhen, received the order recently, the people added. They declined to be identified because they are not allowed to speak to the media.

The total amount of U.S. dollars sold to clients in January for a bank in one of these hubs cannot exceed the amount sold in December, according to the people.

“They have asked us to limit our purchase amount and there are targets, but it mainly relates to institutions and enterprises, there is no change to the policy on individuals,” said one person.

Officials at State Administration of Foreign Exchange did not immediately respond to comment.

China also suspended forex business for some foreign banks, including Deutsche, DBS and Standard Chartered at the end of last year.

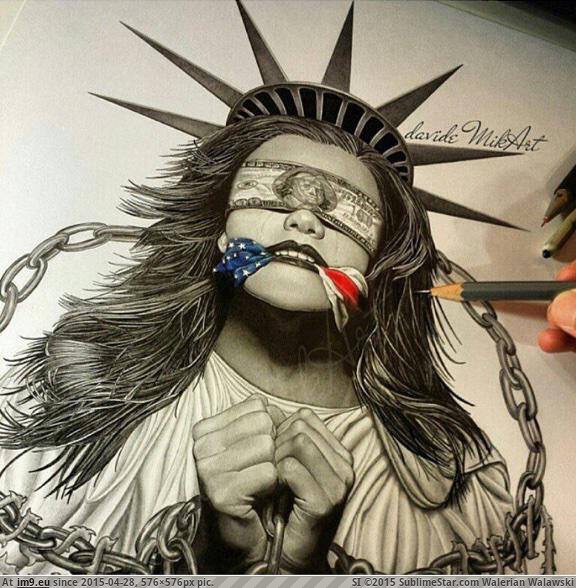

While the sources for this story claim they were told that this is an effort to stem the outflow of capital, others say this is a reflection of the belief in China that the US Dollar is now worthless and will soon totally collapse as a currency, leaving everyone who holds dollars, broke.