If anyone has stopped to ask just why global central banks are in such a rush to create inflation (but only controlled inflation, not runaway hyperinflation… of course when they fail with the “controlled” part the money paradrop is only a matter of time) over the past 5 years, and have printed over $12 trillion in credit-money since Lehman, the bulk of which has ended up in the stock market, and which for the first time ever are about to monetize all global sovereign debt issuance in 2015, the answer is simple, and can be seen on the chart below.

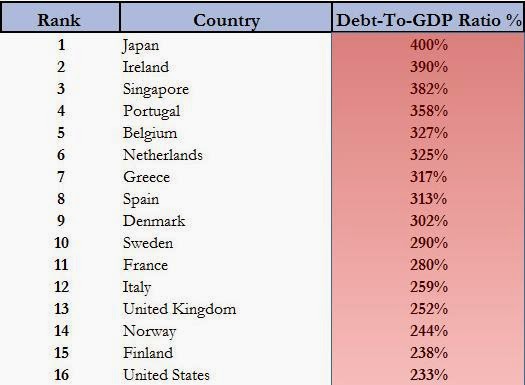

It also shows the biggest problem facing the world today, namely that at least 9 countries have debt/GDP above 300%, and that a whopping 39% countries have debt-to-GDP of over 100% …. http://www.zerohedge.com